Individual health insurance rates set to drop by up to 60% as a result of Maine health care reform

There is encouraging news for Mainers coming out of the health care industry. Rates for individual health care plans in Maine are set to drop as much as 60% this July as a result of health reform law PL 90, also known as LD 1333, adopted in March 2011.

PL 90, the free market based health reform law, was passed last March by a Republican majority in Maine’s legislature. Governor Paul LePage signed the bill in a ceremony at the statehouse amid cries from Democrats that it wasn’t right for Maine.

“The law takes Maine in the wrong direction,” said Emily Cain, the house Democrat leader, at the time the bill was passed. But, if you’re a Mainer looking for individual health coverage, you’re probably going to be encouraged by the direction private health care costs are going – down.

“Since the law took effect this past October, we have primarily seen the laws impact to Maine’s small group insurance market with the vast majority seeing lower premiums,” said Joel Allumbaugh, President of the Maine Association of Health Underwriters and Health Care expert at the Maine Heritage Policy Center. “Now we are seeing huge progress in the individual insurance market as well, with rate decreases up to 60%, it’s a huge step forward for Maine.”

The rate filing, submitted this week by Anthem, the primary insurer offering individual plans in Maine, is not yet official. The rates would take effect in July, but first must be approved the state Insurance Superintendent. If the rates do take affect, it will be a relief for those paying for private individual insurance, or those who want to purchase a plan.

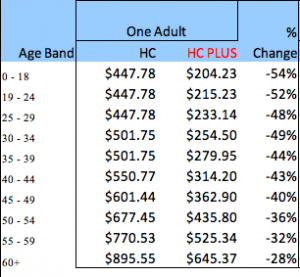

PL 90, the health reform law that Republicans guided through the legislature despite passionate opposition from Democrats, expanded the “rate bands” to allow a wider variation in cost between different aged applicants. In the past, insurance companies had to treat a 21-year-old and 55-year-old as basically the same. The new law allows for distinction in age groups.

Democrat Representative Sharon Treat was one of the strongest advocates against PL 90 during the debate about the health reform law. “Unfortunately, in the rush to pass LD 1333 [PL 90], the Republican majority is creating obstacles to better coverage and reduced costs,” she said at the time.

Now, it’s becoming evident that reducing costs to individuals is exactly what the law has done.

Even the “closed book” plans, which are individual plans that are renewing, versus brand new plans, are seeing benefits from the new law. In the past, the policies in the “closed book” category have seen yearly increases well above 10% annually. In the July Anthem filing, the average rate increase is just 1.7%, good news for those already holding individual policies.

Some of the new plans being offered in the individual market by Anthem, called the “HealthChoice Plus Product” include mental health services at no extra cost, when in the past the plans required a “rider” which raised rates by as much as 30%. Not only do the new plans cover mental health, they costs significantly less.

HealthChoice* $2,250 Deductible w/o Mental Health Vs. New Healthchoice Plus $2,000 Deductible w/Mental Health

For the plan holder 60-years-old and over, the current plan would cost $859 per month. As a result of the health reform law, the new plan would cost $645, a 28 percent decrease per month.

This is before new competition enters the fray, a likely scenario that the new law makes possible. Allumbaugh said that he anticipates additional insurers will enter the market, but are not prepared to offer products as early as July.

When new competition does enter the market, it would drive rate even lower, according to Allumbaugh.

Young people are big winners in the rate decreases. A 19 to 24-year-old will be able to purchase a health plan with a $2,000 deductible for about $200 per month, a significantly more affordable option than the current $450 per month for a similar plan. For many, this may be the difference between not being able to afford health care, and holding their own private policy.

A 19 to 24-year-old with a higher deductible of $10,000 could carry a policy for just $100 a month, less than the going rate to pay for a typical monthly iPhone plan. This could be especially important for those in that age bracket who may no longer qualify for MaineCare if cuts are passed in the supplemental budget being voted on this week to close an $80 million budget gap.

“Getting more young people into the market is a major plus for all Mainers and was a primary goal of the law,” Allumbaugh notes. “As this happens, the claims experience tends to improve and it can lower the rates even further for all age groups,” Allumbaugh said.

“This is precisely the impact the health reform law aimed for, lowering rates generally, but in a way that helps our insurance markets reverse the death spiral and begin to grow.”

http://www.themainewire.com/2012/05/individual-health-insurance-rates-set-drop-60-result-maine-health-care-reform/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_8.gif)

No comments:

Post a Comment